Let’s face it, advertising car finance isn’t what it used to be.

Once upon a time, it was enough to throw a few flyers in the showroom or pop an ad in the local paper with “Finance Available” slapped across the top. But those days are long gone. Today, every single message you send out, from a billboard to an Instagram story, is under the spotlight. And if it’s about finance, it’s under even more scrutiny.

The Central Bank of Ireland and the Advertising Standards Authority are watching. And they’re not just interested in the big banks or lenders like Close Brothers — they’re looking at you, too, especially if you’re acting as a broker for finance.

So, let’s break down what you need to know, in plain English, to stay compliant and avoid any unwanted attention.

First Things First: What Actually Counts as Advertising

First Things First: What Actually Counts as Advertising?

Short answer? Pretty much everything.

We’re not just talking about TV or radio anymore. The rules cover things like:

- Google ads

- Facebook and Instagram posts

- Sponsored influencer content

- WhatsApp broadcasts

- TikTok videos

- Website banners

- SMS messages

- Pop-ups and email campaigns

- Even the wording on your window stickers

If it talks about finance, especially if it mentions rates, affordability, or monthly payments, it’s considered advertising. And that means it needs to follow the rules.

Who Sets the Rules?

There are two big players you need to know:

- The Central Bank of Ireland, via the Consumer Protection Code 2012

- The Advertising Standards Authority for Ireland (ASAI), which enforces the Code of Standards for Advertising and Marketing Communications

If your dealership or brokerage helps arrange car finance, then you need to follow both. Full stop.

What the Central Bank Cares About

The Central Bank’s golden rule is simple: be fair, be clear, be accurate.

Your finance ads need to:

- Be balanced (don’t scream “0% FINANCE!” in bold caps and bury the T&Cs in a tiny footnote).

- Avoid language like “best deal,” “lowest rates,” or “leading broker” unless you can prove it (and cite the source).

- Give people the full picture of what they’re signing up for — that means rates, repayments, total cost of credit, duration of the loan, and the full breakdown.

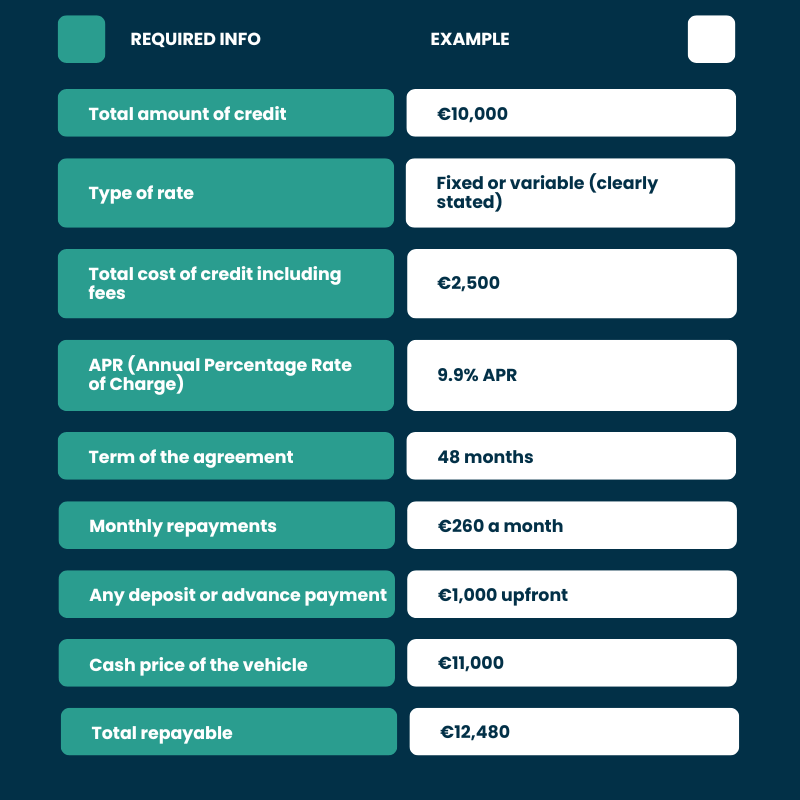

Example of What Needs to Be Included

If you mention any interest rate or cost of credit in your ad, you must include. 👉

This isn’t optional, it’s a legal requirement under the European Communities (Consumer Credit Agreements) Regulations 2010. If you’re advertising finance without it, you’re already in breach.

What Not to Say

Be careful with marketing buzzwords that sound great but don’t stand up to scrutiny:

- ❌ “We work with all lenders” – unless you literally work with all of them.

- ❌ “Guaranteed approval” – nope. Every application has to be assessed fairly.

- ❌ “Best value finance” – only say it if you’ve got solid evidence from a reputable, recent source.

The Central Bank has pulled up firms for this kind of language before. Don’t give them a reason to pull yours.

Everyone Needs to Be on Board

This isn’t just a job for the marketing team. It’s something your whole business needs to be across, especially:

- Directors or board members

- Sales teams

- Compliance staff

- Website developers

- External agencies (they’re creating your content, they need to know the rules)

Work together to make sure what you’re putting out there is compliant before it goes live. Fixing it later could mean fines, pulled ads, or even reputational damage.

Where to Get Help

Here are some helpful resources:

- Consumer Protection Code 2012 – read it, bookmark it, refer to it often.

- ASAI Code – the full guidelines for all advertising in Ireland.

- Central Bank’s Advertising Guidance for Credit Providers – a great breakdown of what’s expected in car finance advertising.

Final Thoughts

Let’s be real, most dealerships and brokers want to do the right thing. But the rules around advertising car finance in Ireland aren’t always obvious, and with new formats popping up every year, it’s easy to slip up.

The key takeaway? If you’re advertising finance, you’re part of the financial services industry, and you’re expected to play by those rules.

At LM Operations, we don’t just provide regulated finance solutions; we keep our partners informed with practical advice on staying compliant and confident.

Need a second opinion on your finance messaging? Or want to partner with a lender who’ll keep you ahead of the curve? Partner with LM Operations today.

FAQs: Car Finance Advertising Rules in Ireland

What are the advertising rules for car finance in Ireland?

If you’re advertising car finance in Ireland, you must comply with both the Consumer Protection Code 2012 (by the Central Bank of Ireland) and the ASAI Code of Standards. Ads must be clear, fair, accurate, and balanced. Any mention of rates, costs, or repayments must include full financial disclosures such as APR, loan amount, total cost of credit, term, and monthly payments.

Do car dealerships in Ireland need to follow Central Bank advertising rules?

Yes. If a dealership promotes or brokers car finance, they are considered part of the financial services ecosystem and must follow Central Bank regulations, even if they’re not a direct lender.

What must be included in a car finance ad in Ireland?

Any car finance ad in Ireland that mentions a rate, repayment amount, or cost must include:

- Total credit amount

- Type of rate (fixed or variable)

- Total cost of credit

- APR (Annual Percentage Rate)

- Term of agreement

- Monthly repayments

- Deposit or advance payment

- Cash price of the vehicle

- Total repayable amount

Can Irish car dealers advertise “guaranteed car finance approval”?

No. Advertising phrases like “guaranteed approval” are prohibited unless you can absolutely prove they apply in every case… which is nearly impossible. All finance applications must be assessed individually and fairly.

Are Facebook and Instagram posts counted as car finance advertising in Ireland?

Yes. Social media posts, including Facebook, Instagram, TikTok, and even influencer content, are considered advertising if they mention finance options. This means they must follow all applicable finance advertising rules, just like traditional ads.

Can I say “best car finance deal in Ireland” in my ad?

Only if you have verifiable, up-to-date evidence to back up the claim. The Central Bank expects that any superlative claims — like “best deal” or “lowest rates” — are factual, current, and from a reputable source. If not, you could face penalties.

What happens if I break car finance advertising rules in Ireland?

Non-compliance can lead to warnings, fines, public naming by the Central Bank or ASAI, and reputational damage. In serious cases, your finance partnerships could be at risk.

Is it enough to put car finance terms in the small print?

No. Key finance information like APR, repayment terms, and total cost of credit must be as prominent as the offer itself. Hiding details in small print, footnotes, or hard-to-read formats is not compliant.

Who regulates car finance advertising in Ireland?

Two main bodies:

The Central Bank of Ireland (via the Consumer Protection Code 2012)

The Advertising Standards Authority for Ireland (ASAI)

Both organisations monitor finance-related ads across all media — online and offline.

Where can Irish car dealers get help with compliant advertising?

Dealers and brokers can review:

The Central Bank’s Advertising Guidance for Credit Providers

The Consumer Protection Code 2012

The ASAI Code

Alternatively, working with a regulated finance partner like LM Operations can help ensure your advertising stays compliant.